1. to accept a bill

1. to accept a bill

2. account

3. actual yield

4. after-hours trading

5. at a discount

6. at a premium

7. at best

8. at closing

9. on demand

10. backdate

11. to bank – to deposit

12. bank

13. bank account

14. bank balance

15. bank branch

16. bank counter

17. bank credit

18. bank deposit

19. bank guarantee

20. bank loan

21. bank rate rise

22. bank sector

23. bank transfer

24. bank transfer order

25. banking

26. banking secrecy

27. exchange-rate fluctuations

28. exchange controls

29. exchange rate

30. exercise an option

31. to expire

32. expiry date (UK) – due date (US)

33. financial market

34. fixed exchange rate

35. fixed term sale

36. floating-rate loan

37. foreign bank

38. foreign currency

39. foreign exchange market

40. forward market – futures market

41. future transaction

42. futures – forward contracts

43. to grant a loan

44. to gross yield

45. to honour a bill

46. in the red

47. interest

48. interest accrual

49. interest rate

50. investor

51. irrevocable

52. irrevocable letter of credit

53. issue price

54. issuing bank

55. issuing house

56. legal interest

57. letter of credit

58. to loan

59. banking system

60. bill

61. to bear

62. bear market

63. bearer bill

64. bearer bond

65. bearer share

66. bill for collection

67. blank cheque

68. blank endorsement

69. bond – debenture

70. bond certificate

71. bond holder (UK) – debenture holder (US)

72. bond issue

73. bonus share

74. bull market

75. to buy back

76. call option

77. to cash a cheque

78. cash market

79. cash overdraft

80. cashier (UK) – teller (US)

81. to charge an account

82. cheque (UK) – check (US)

83. cheque book

84. collection

85. commodity exchange

86. confirmed irrevocable credit

87. confirmed letter of credit

88. merchant bank

89. money laundering

90. money market

91. negotiable

92. negotiable bill

93. net yield

94. official discount rate

95. official Stock Exchange list

96. on deposit – on consignment

97. to open an account

98. ordinary share (UK) – common stock (US)

99. to overdraw

100. parity

101. payable at sight

102. payable to bearer

103. payment order

104. postdate

105. preference share (UK) – preferred stock (US)

106. premium deal

107. private bank

108. promissory note – note of hand

109. to protest a bill

110. to protest charges

111. rate

112. recipient (UK) – beneficiary (US)

113. registered share

114. to renew the bill

115. repayment date (UK) – refund date (US)

116. revocable

117. revocable credit

118. revocable letter of credit

119. right of veto safety deposit box

120. savings bank

121. convertibility

122. convertible

123. convertible bond

124. correspondent bank

125. crash on the Stock Exchange

126. credit

127. credit card

129. credit opening

130. currency exposure

131. current account

132. current account deposit

133. date of issue

134. debit balance

135. default interests

136. deposit

137. deposit book

138. deposit certificate – deposit warrant

139. depositor

140. discount rate

141. dividend

142. dividend warrant

143. domiciled bill

144. draw a cheque

145. drawer

146. drawer’s signature

147. end of month (EOM)

148. to endorse – to back

149. to endorse a cheque

150. endorsement

151. endorser

152. exchange

153. exchange broker (UK) – stockbroker (US)

154. savings deposit

155. to sell forward

156. to settle a debt (UK) – to pay off a debt (US)

157. settlement of a bill

158. share (UK) – stock (US)

159. share certificate

160. share index

161. share issue

162. short-term bill

163. short-term debt

164. bill on demand

165. speculative bubble

166. spot exchange

167. stock dividend

168. Stock Exchange

169. Stock Exchange index

170. stock market

171. stock option

172. stockbroker

173. to stop a cheque

174. to stop an account

175. subject to collection

176. surcharge

177. guarantee

178. take-over bid (TOB)

179. to take out a loan

180. town cheque

181. transferable

182. unacceptance

183. unpaid – unsettled

184. value at market price

185. to write out a cheque

186. yield

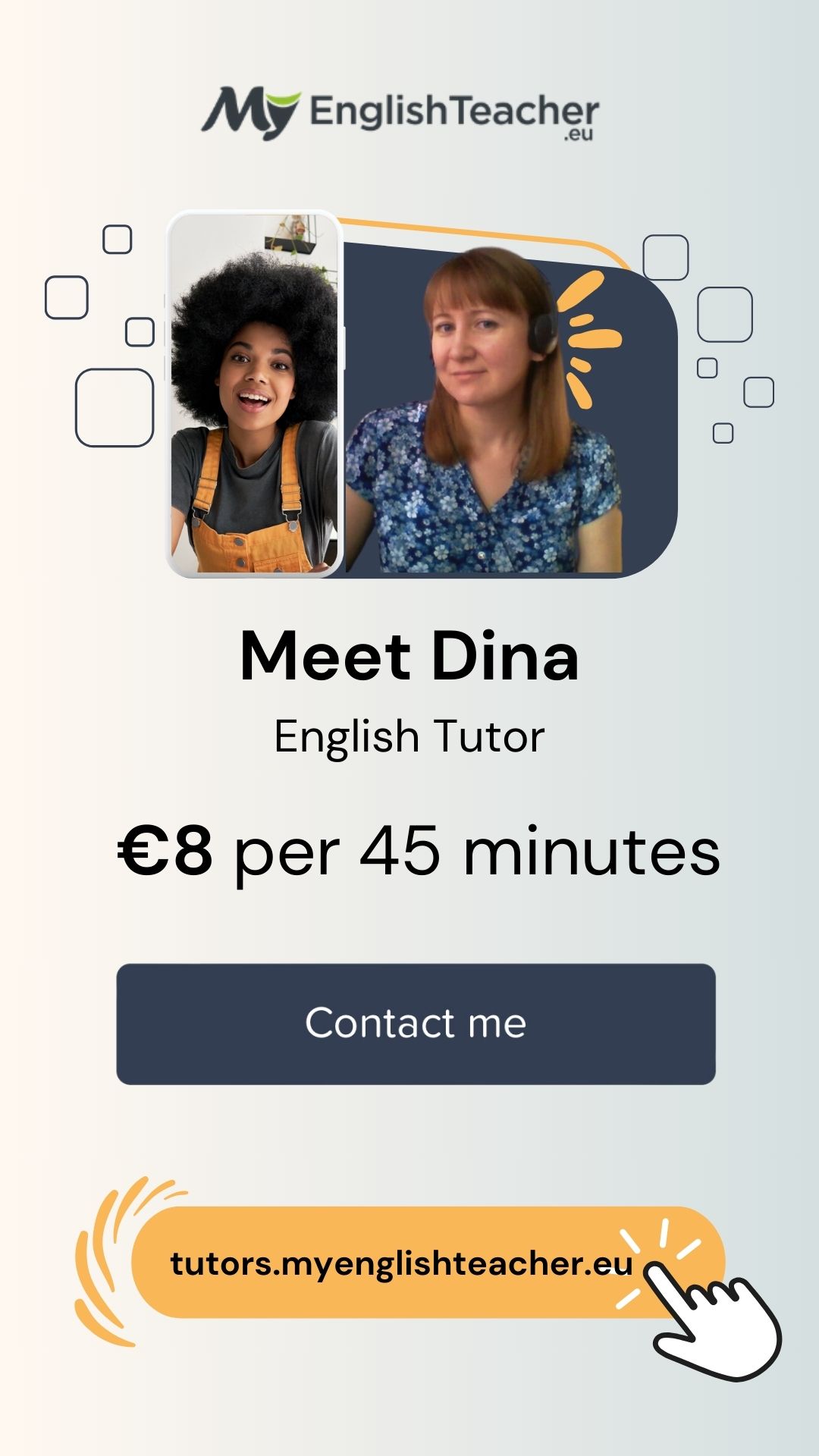

What’s next?

Improve your business English skills with qualified native English teacher via Skype. We offer high quality English lessons, so you will be able to improve your English rapidly.

Image by Pinterest