Fintech

Is short for financial technology. Simply put, it includes technology, especially computer programs that are used to support and create banking and other financial services.

The fintech industry is a combination of modern technology and the desire of millennial‘s and younger generations to have a seamless and integrated banking and financial services experience.

Fintech companies have made their way into all kinds of financial transactions, including transferring money, lending money, investing, and making payments. The term can apply to a wide array of companies and technology.

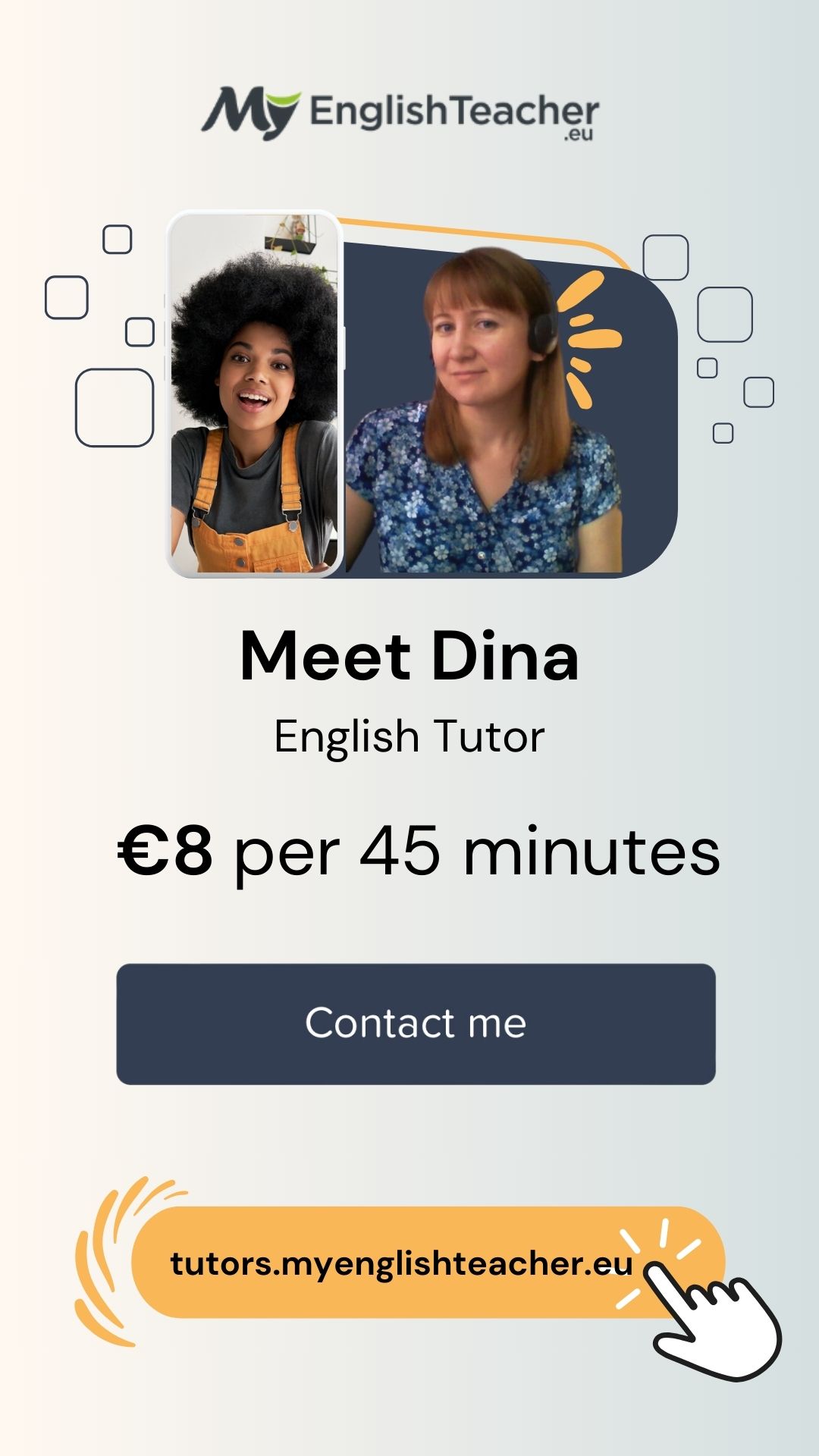

Skype English Lesson with a native AMERICAN or BRITISH teacher ››,

Originally fintech was used to describe the technology that was being used in the back end of established traditional banks and financial institutions.

However that has changed significantly over the last 5 to 10 years. Fintech is now thought of as innovative start up companies that in many ways disrupt the traditional financial sector.

It includes financial literacy, education,, no fee trading apps , banking, peer to peer lending sites, and even crypto currencies like bitcoin.

Because of regulations traditional banks struggle to keep up with the increasingly digitized demand from customers, therefore leading to a boom in the fintech industry.

Where this technology driven industry will go next is anybody’s guess. But we can assume that whatever this industry does it will continue to make financial services quicker, easier, and more readily available to the average person.

In 2017 $4 billion was given to start up’s to help them finance their fintech companies. According to CB insights 26 fintech companies were valued at a combined $83.8 billion, making this disruptor a huge industry.

These billion dollar juggernauts include innovation in blockchain technology, open banking, reg tech (which helps companies keep up with financial regulations), Smart contracts, crypto currency and digital cash, robo advisers, cyber security, and unbanked and underbanked services.

Let’s take a look at some of the top fintech companies.

Xero

Is a New Zealand-based company, founded in 2006. It specializes in online accounting software for small businesses. It currently has over 1 million subscribers.

It provides customers with automated daily bank fees, invoicing, a cash book, debtors, creditors, reporting, and sales tax services. In 2016 it did over $NZ 1.4 trillion in transactions.

Oscar

Is a US based company that was founded in 2013. It melds health insurance and technology together, with the goal of improving the customer’s experience. It does this by providing a faster claim process at a minimal cost.

It’s goal is to make the healthcare system cost effective and efficient for customers. It currently has big name investors, such as Google capital and Fidelity.

Adyen

Auden is a Dutch company founded in 2006. It allows businesses to have a single platform to accept payment through any sales channel from any place in the entire world.

It can count over 4,500 businesses as its clients, who uses it’s payment platform through mobile, online, or in store point of sales. Some of its top customers include well-known companies such as Netflix, Loreal, Microsoft, Facebook, Berberry, and Uber.

It has a revenue stream of over $700 million a year, and over $90 billion worth of transactions were processed through the company in 2016.

Qudian

Is a Chinese company, that was founded in 2014. It primarily operates as a student micro loan site. It is China’s answer to credit cards.

Credit cards are a popular form of using installment payments in the west, but that is not a common investment tool in China.Qudian seeks to fill the space.

It partners with several e-commerce and digital financial services companies to help attract its customers it currently is projected to facilitate over 80 billion yuan in loans.

Ant Financial

Is a China based spin off of the Alibaba group. It originated from Alipay and was officially founded in 2014. It is the third largest payment platform in the world.

Ant Financial includes Alipay, Ant Fortune, and Ant Financial Cloud. It covers wealth management, private banking, cloud computing, payments, and credit reporting. It is valued at an estimated $75 billion.

SoFi

Is s US, San Francisco based company, that was founded in in 2001 by Students who met at Stanford University. The company takes a nontraditional approach to lending and wealth management.

The company focuses in mortgage loans, personal loans, student loan refinancing, life insurance, and wealth management. Since its inception it has loaned over $19 billion to over 300,000 members.

Skype English Lesson with a native AMERICAN or BRITISH teacher ››

Thanks for sharing this informative post with readers. I will share this post with my nexter team members at https://nexter.org/category/cool-tech they will find this information very useful.

Thanks for sharing this informative post with readers. I will share this post with my nexter team members at https://nexter.org/category/cool-tech